Calash is pleased to announce that it provided commercial due diligence support to Averroes Capital on its acquisition of Glacier Energy, a specialist provider of products, services and engineered solutions for renewable and conventional energy markets.

Averroes Capital has acquired the business from incumbent institutional investors Maven Capital and Simmons Parallel Energy Fund, which had first invested in Glacier when formed in 2011. The incoming investor will also provide growth capital to allow Glacier to invest in strategic growth initiatives.

Calash’s commercial due diligence focused on assessing the company’s key renewables and conventional energy end markets, its growth strategy, competitive positioning, its products, services and operations, and a customer and market referencing exercise.

“It was great to work with Calash. The team was responsive, professional and highly knowledgeable, providing critical commercial due diligence that really made a difference to our understanding of Glacier and its growth journey. We look forward to working with them again in the future.”

Simon Rowan, Partner at Averroes Capital

Read more here.

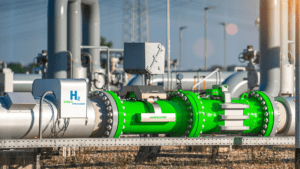

Glacier Energy was founded in 2011 with the acquisitions of Roberts Pipeline Machining and Wellclad by Maven Capital and Simmons Parallel Energy Fund. Glacier has been leveraging its engineering and technical capabilities to support low carbon technologies including hydrogen, carbon capture and energy storage with their core capabilities focused on heat transfer and pressure vessels, machining, welding and NDT and inspection. As it embarks on further growth, Glacier Energy is focused on taking advantage of positive market drivers in the energy landscape, in particular the energy transition, energy security initiatives and decommissioning. These trends are driving investments into both low carbon technologies and existing energy sources.

Averroes Capital partners with ambitious management teams to build great businesses. Through collaboration, alignment and flexibility, we create an investment approach that works whilst ensuring each company has the support and capital to deliver their growth ambitions. Averroes invests between £15 million and £40 million of equity into high-quality, growing businesses that operate in specialised markets. It provides majority or significant minority buy-out and growth capital.