Calash advises Foresight Group on its investment into Quanta EPC

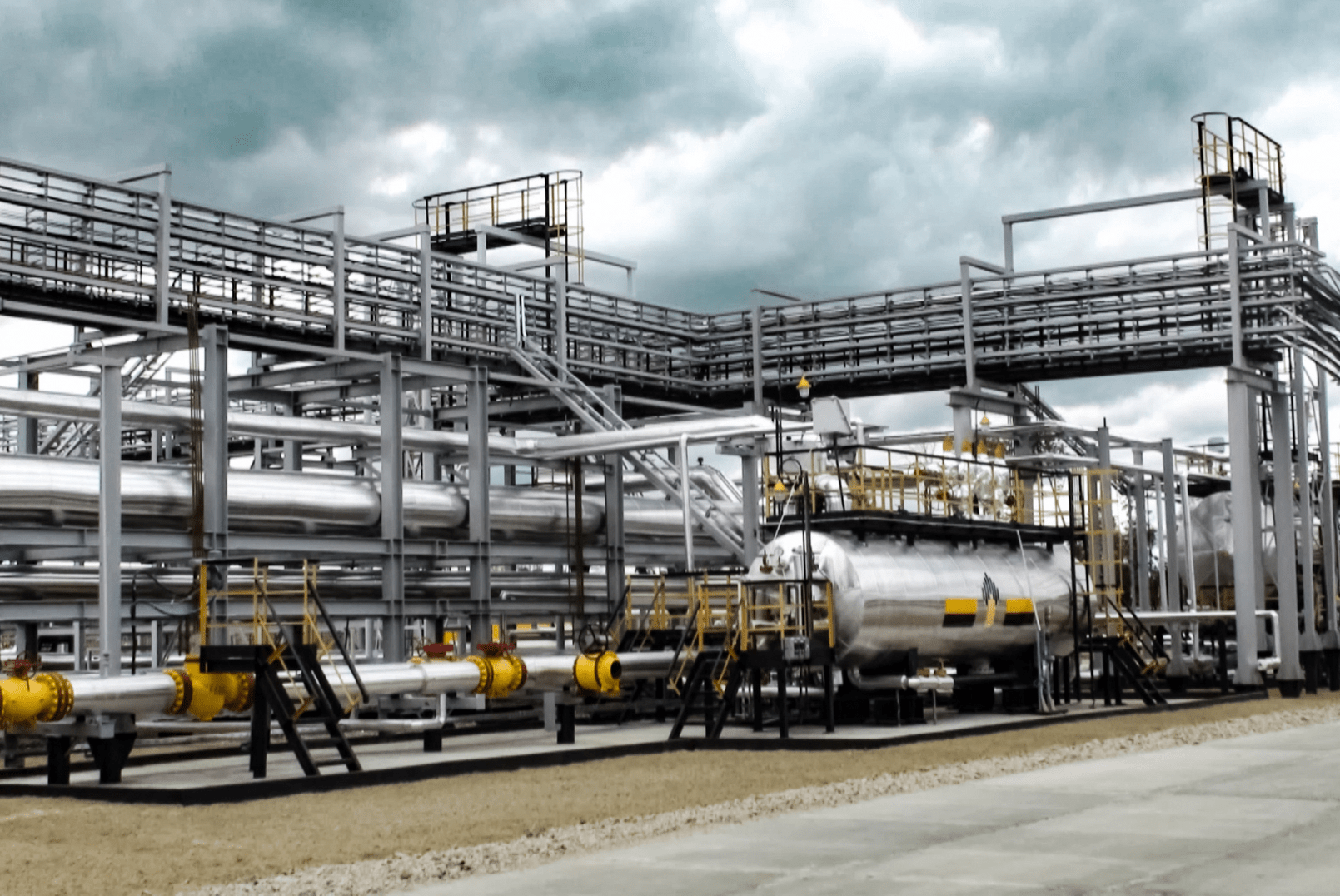

Calash is pleased to announce that it has provided commercial due diligence in relation to the investment by infrastructure and private equity investment manager Foresight Group on its investment into Quanta EPC Holdings Limited, a specialist provider of engineering and