Calash is pleased to announce that it has provided environmental and commercial due diligence to private equity investor Chiltern Capital on its investment into Empteezy, a designer, manufacturer and distributor of industrial safety products and solutions, focused on environmental protection, spill prevention and EV battery storage.

Founded three decades ago by Bruce Wishart, Livingstone-headquartered Empteezy has grown into a leading pan-European operator serving a range of blue-chip customers from sites across the UK, France, Spain, Germany, Italy and Belgium

The transaction is in the form of a management buy-out led by Empteezy’s CEO and CFO, David Byrne Jon Hazlewood, respectively. The team has been joined by Warwick Ley as chairperson. Chiltern will support the team in delivering a growth plan to broaden Empteezy’s product and service offering and make further funding available for targeted M&A.

Calash provided commercial due diligence and environmental due diligence on the deal on behalf of Chiltern. Environmental due diligence involved individual site surveys for Empteezy’s four sites across the UK and France, plus further remote assessment of its operations in Italy, Germany, Benelux and Iberia, identifying contamination, compliance, and safety risks.

Commercial due diligence included a review of the target’s business activities, service demand from existing and adjacent markets, and a competitive benchmarking exercise.

The Calash team included Rob Neves, Iain Gallow, and David Wilson.

“Calash provided the hands-on operational expertise needed to get to grips with Empteezy’s market and positioning. The team got stuck into the project, working with us over an extended period, and really demonstrated the value of assessing an opportunity from both a commercial and environmental perspective. We look forward to working with Calash on our buy-and-build plan for the Group too.”

David Butler, Investment Director, Chiltern Capital

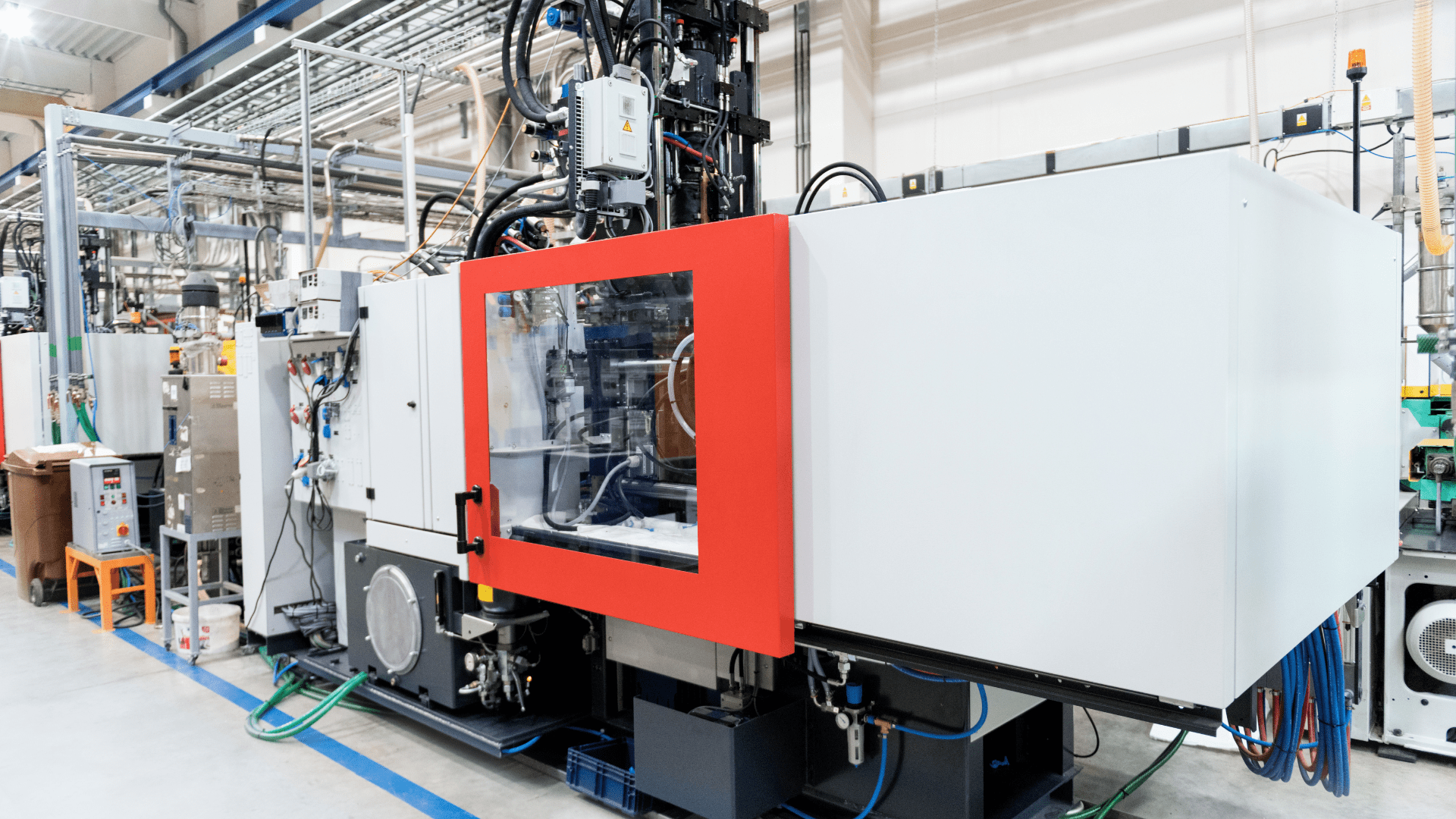

Empteezy Group is a collection of international manufacturing corporations specialising in spill control, spill containment and spill response solutions. Founded in 1986, Empteezy UK Ltd was launched in West Lothian, Scotland by founder Bruce Wishart. Initially developing a patent for the auto-tipping skip. Empteezy now consists of nine companies working across a variety of solutions, including spill control, spill containment, bunded storage, flammable liquids storage, forklift attachments, site safety, oil storage regulations compliance, and decontamination.

Chiltern Capital is a lower midmarket-focused private equity investor. It aims to build enduring relationships with management teams and work together to create value. It looks to invest up to £40m of equity to support companies that are established and profitable, headquartered in the UK or Ireland, and have significant growth and development potential.