Carbon capture, use and storage (CCUS) presents an opportunity for businesses and investors with deep experience in the oil and gas market to repurpose equipment, services, and technical expertise in an adjacent ESG-friendly sector.

But many still regard the commercial maturity of the space with a degree of skepticism and are hesitant to commit, given it has been seen as a sticking plaster used by international oil and gas companies to justify continued fossil fuel extraction.

While this may have some truth, the large-scale roll out of CCUS has now become an integral part of most national net zero stories, without which hard to abate industrial processes will be unable to decarbonise.

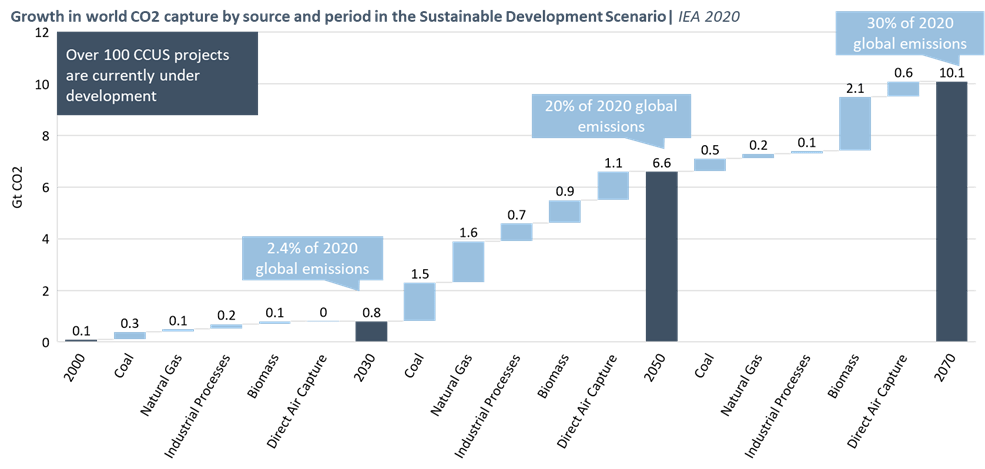

It is understood that up to 20% of the CO2 emissions from power generation and heavy industry could be removed via CCUS by 2050, with fossil-fired power plants potentially seeing a 90% removal of emissions.

The implementation of CCUS will require heavy engineering with significant capital expenditure, and then continual spend on maintenance and inspection once in operation. This presents an opportunity to develop new technologies in an adjacent space in which established industrial and energy equipment and service providers can diversify.

Large scale CCUS infrastructure projects will use onshore engineering skills and technology that have a close overlap with traditional natural gas distribution, while offshore segments – sending the CO2 back out to sea – is analogous with midstream oil and gas.

However, there are also new technologies and engineering knowledge that will need to be developed, from better membranes used to capture the CO2, through to the transportation process, and to sequestration.

Industrial logic

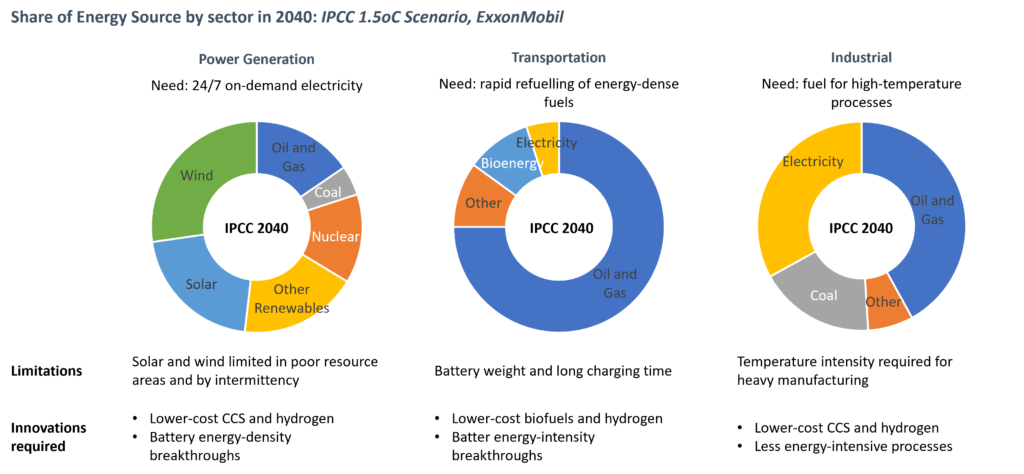

The three largest sectors responsible for producing CO2 emissions are power generation, transportation and industrials. Alternative means of energy have begun to displace hydrocarbons in all three sectors, especially wind and solar within power generation, but there will continue to be a degree of reliance on fossil fuels for a number of decades.

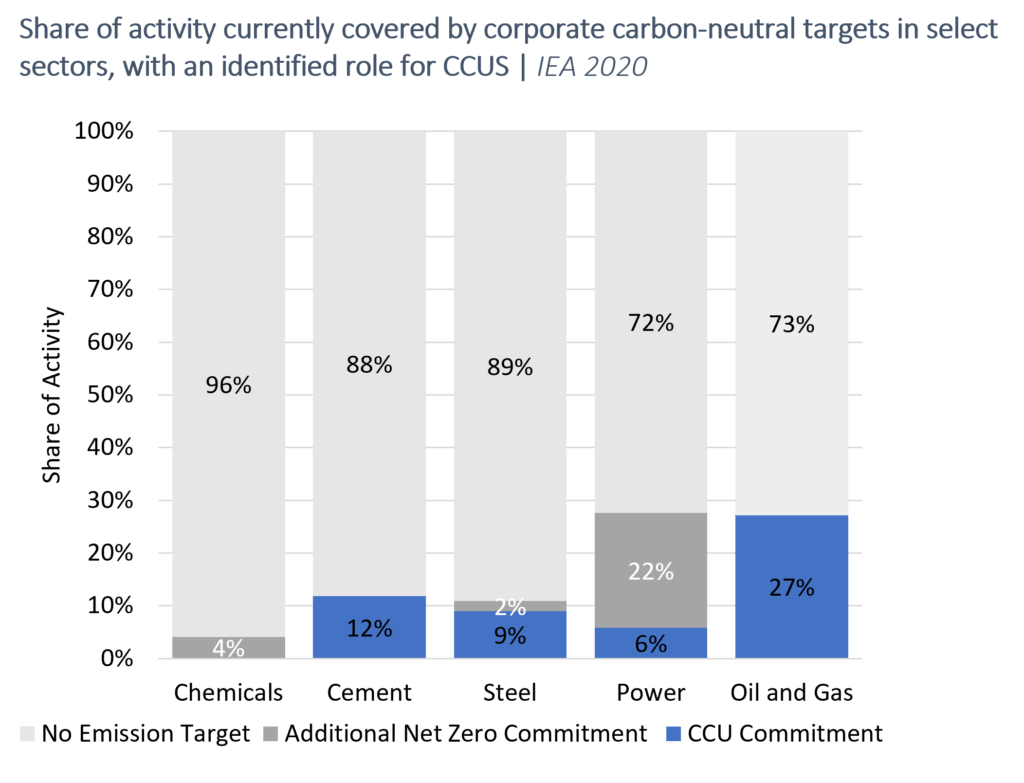

Key industrial segments such as steel and cement production are heavy CO2 emitters. Carbon reduction isn’t just an oil and gas issue.

There are over 1,000 cement producers globally, with over 2,300 integrated cement plants that produce four billion tons of cement per annum. This accounts for 8% of global greenhouse gas emissions, due to its heavily reliant on coal and oil to reach the extreme temperatures required for production.

Point source carbon capture is key to mitigating Scope 1 emissions in this industry, as with steel production.

New industries will also emerge alongside the adoption of carbon capture, most notably the production of blue hydrogen. The cost of blue hydrogen, which requires removing the CO2 from methane, is dependent on commercially viable CCUS technology.

Hub and spoke approach

CCUS projects are concentrated in North America, Europe and Asia, where there are developed investment markets with aligned sustainability objectives.

Many countries, including the UK, are taking a hub-and-scope approach to large-scale carbon capture and storage.

The UK has approved two industrial megaprojects, the East Coast Cluster and HyNet North West, and is in the process of forming a dual subsidy framework, firstly a regulated asset base (RAB)-type payment related to the offshore infrastructure, and then a contract-for-different (CfD) type payment for the emitters.

There are other projects that have significant investor backing but have yet to be fast-tracked, such as the Acorn project in Scotland, which, much to the chagrin of those north of the border, was placed as a reserve. The government intends to sanction four clusters by 2030, which in total intend to capture 20-30 MT of CO2 per year, which is equivalent to between 5-10% of the UK’s annual emissions.

The principle is to cluster carbon emitting industries together with the infrastructure to transport, via pipeline, the compressed CO2 to be sequestered under the seabed in former oil and gas reservoirs. This, the North Sea Transition Authority has launched its first licensing round for offshore carbon capture capacity, with thirteen new areas to add to the current six.

These projects involve some of the largest sponsors in the oil and gas sector, including BP, Shell, Neptune Energy, and Equinor, on the offshore segment of the schemes. The list of corporate partners as onshore emitters is long, with power generation, fertiliser, mining, and manufacturing businesses, among others, looking to contribute.

The East Coast Cluster alone estimates it will generate more than 25,000 jobs per year until 2050, and saw 25 such emitters shortlisted in March as part of the next phase of the government’s phase-2 sequencing process.

Meanwhile Acorn, while initially missing out on the, hopes to become commercially viable without the proposed government subsidies, though there is still a reasonable chance it will gain state backing.

Alongside the industries onshore in Aberdeenshire, it plans to be able to receive ship-transported CO2, and therefore soak up excess emissions from anywhere in the world.

Its project developer, Storegga, is also developing direct air capture and hydrogen technology.

These megaprojects will involve multibillion pound project financing packages, linked to the two different regulated revenue streams, with several of the sponsors having already begun the fundraising process.

The effect of this on the equipment and engineering value chain will be seen in the years ahead, as capital filters down the supply chain and new technical challenges emerge.

For venture capital, private equity, and corporates positioned for diversification, the route to market entry will be critical in capturing any of this emerging growth.

Investment risk and opportunity

The CCUS industry resembles the oil and gas sector, particularly the LNG space, and requires similar forms of technology and engineering.

However, it is not identical, given the properties of compressed or liquefied CO2 are different from gas and oil. Inefficiencies in current direct point capture, and direct air capture, technologies also present a technical gap to commercialisation, while the method and science behind seabed sequestration will need continual improvement to reduce environmental risk.

Membranes, pipes, flanges, compressors, subsea equipment, and transportation vessels – are all areas that will need research and development, and investor focus, to be repurposed for CCUS.

Vessels have been adapted to transport liquefied CO2 in the past, but not on the scale that is required by a global, industrial-scale CCUS sector. Several shipbuilders are rolling out vessels specific to this purpose and technology will continually evolve to fit these ships with the best pumping, compression and unloading equipment for use with CO2.

There are many factors that continue to deter would-be investors. While some governments are exploring state-backed support, there remains a lack of clarity around the regulatory environment for CCUS in many jurisdictions, and few, if any, proven financial business models exist.

The returns to be had from CCUS are perceived as low, and are paired with high technical and regulatory risk. Where new regulated subsidies are not being developed, the reliance on current carbon market pricing provides high levels of uncertainty, which is compounded by the lack of a recognised trading platform for global emissions.

The stakes are high. Betting on a new piece of kit applicable to CO2 capture, transportation or storage could lead to a dead end.

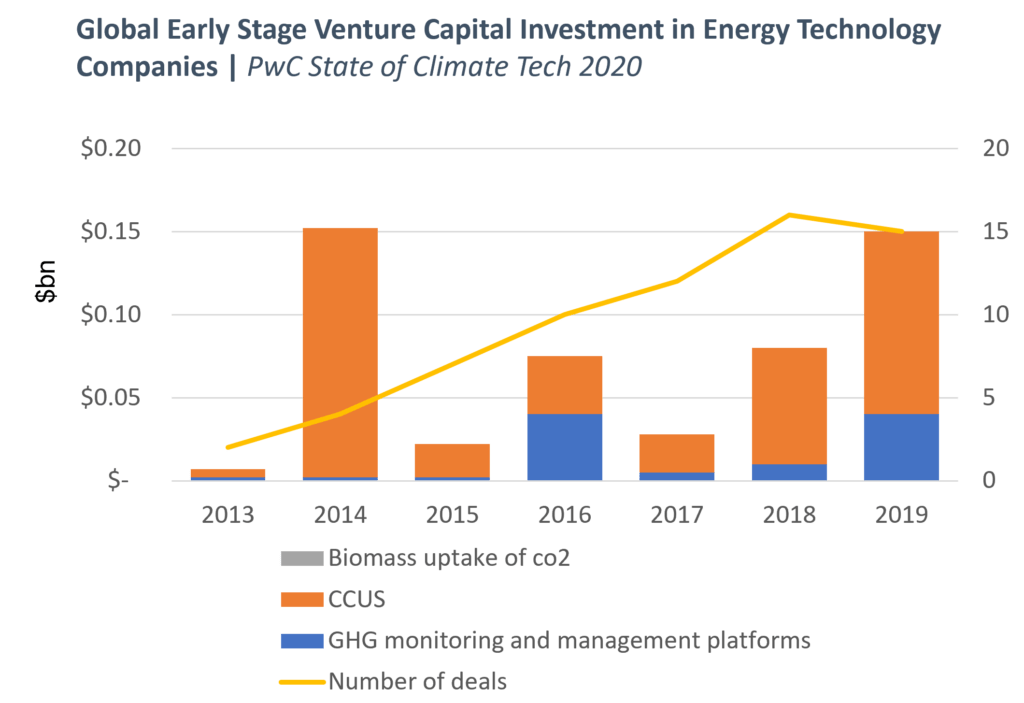

Initially, it will remain the playground of venture capital funds and high-net worth investors, and the VC arms of the large energy companies, to pioneer these new technologies and begin technical validation.

The commercial development of the CCUS market will continue in parallel with the technical development of the components needed to make it feasible. This will mean that the target market for new products and services will be shifting and difficult to predict, creating a hard-to-measure investment risk profile.

This is similar to those seeking to invest in the hydrogen space, where the risk of holding a widowed investment is high.

It is likely that much of the technology still being developed for CCUS will jump from the hands of VCs to the operators and top-tier energy equipment and service providers.

However, new players could emerge should private equity step into the gap and try to build platforms focused solely on the CCUS space, or if any existing strategies pursue an aggressive consolidation strategy to build a sector champion. This will depend on the speed of the maturity of the revenue stream, and the availability of credible buy-and-build targets.

Needless to say, any new investment or capital raise will need diligence, in its general definition of the word and in the specific form of commercial, technical and environmental due diligence.

The engineering and technical cross over with oil and gas is an alluring proposition to those with a traditional energy background but that need to diversify, however, the competitive environment, commercial proposition, and likely shape of the mature market need to be fully understood.

Calash is an international strategy consultancy that combines seasoned technical and commercial experts and deep sector experience to deliver winning strategies that enable our clients to accelerate value growth. Working across the energy, natural resources, marine, defence and industrial markets, our highly knowledgeable team takes a hands-on approach, delivering concise, tailored outputs and insights that are both pragmatic and commercial.